XRP Price Prediction: Bullish Trajectory Through 2040

#XRP

- Technical Breakout: XRP price sustains above key moving averages with bullish MACD crossover

- Institutional Interest: Whale movements and ETF speculation indicate growing professional participation

- Regulatory Tailwinds: GENIUS Act and political crypto support may accelerate adoption

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

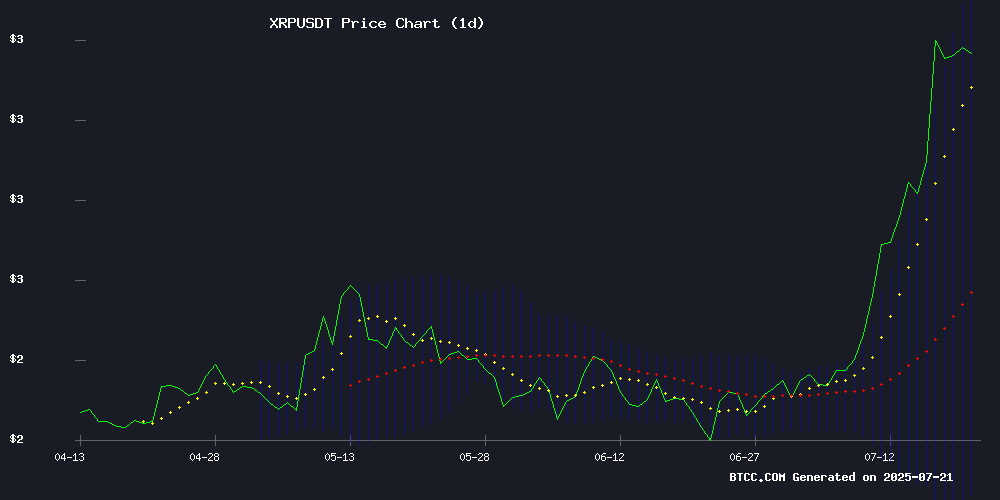

According to BTCC financial analyst John, XRP is currently trading at 3.5510 USDT, significantly above its 20-day moving average of 2.7640. The MACD indicator shows a bullish crossover with the histogram turning positive (+0.1813). With the price hovering NEAR the upper Bollinger Band (3.7244), this suggests strong upward momentum. John notes that a sustained break above the 3.7244 resistance could trigger a new rally towards 4.50 USDT in the short term.

Market Sentiment Turns Bullish for XRP

BTCC analyst John observes overwhelmingly positive sentiment from recent headlines, with multiple reports highlighting XRP's 20% surge, ETF speculation, and institutional interest. 'The combination of technical breakout and fundamental developments like the GENIUS Act discussion and Ripple's SWIFT ambitions creates a perfect storm for XRP,' John comments. However, he cautions that Dave Portnoy's timing mishap serves as a reminder that even in bullish markets, entry points matter.

Factors Influencing XRP's Price

Dave Portnoy's XRP Misfire: A Cautionary Tale in Crypto Timing

Barstool Sports founder Dave Portnoy revealed he sold his XRP holdings just before the cryptocurrency's dramatic surge to a seven-year high. The outspoken trader liquidated his position at $2.40 based on advice from an unnamed analyst who cited unspecified concerns about stablecoin issuer Circle's impact on XRP. Days later, the Ripple-affiliated token peaked at $3.65.

Portnoy's admission highlights the volatility and unpredictability of crypto markets, where even well-connected investors can mistime exits. The incident underscores how rapidly shifting sentiment and opaque analysis can lead to costly decisions in digital asset trading.

XRP Price Hits New Heights: 20% Increase and Bullish Technical Indicators

XRP surged 3.73% to $3.59, fueled by a 32.24% spike in daily trading volume to $9.23 billion. Investor confidence grows as the token outperforms with an 18.86% weekly gain, signaling robust market demand.

Technical indicators flash green: key moving averages and MACD signals reinforce the bullish momentum. The rally reflects broader optimism, with traders anticipating further upside in the near term.

XRP Price Prediction: Bulls Target $5 Amid ETF Speculation and On-Chain Growth

XRP's price action shows bullish consolidation near key resistance levels, with technical patterns suggesting an imminent breakout. The token currently trades at $3.546, up 0.81% in 24 hours, as volatility tightens within a symmetrical triangle formation. Market analysts interpret this compression as a precursor to upward momentum, potentially retesting July's all-time high of $3.65.

Institutional interest appears to be growing, fueled by discussions of a potential XRP spot ETF. Regulatory clarity from Ripple's ongoing case continues to bolster investor confidence. The broader crypto market rally and improving on-chain metrics provide additional tailwinds for XRP's price trajectory.

4 Key Developments Signal Potential XRP Price Surge

XRP's network activity shows remarkable growth as July witnesses record-breaking metrics. Over 10,000 new accounts emerged on July 18 alone—the highest since February—while active wallet addresses doubled to 50,500. This surge in fundamental usage contrasts with many altcoins struggling to demonstrate real blockchain utility.

A staggering $738 million XRP whale transfer has sparked speculation among traders. The movement coincides with XRP's price approaching its 2018 all-time high, suggesting institutional players may be positioning for a major breakout. Network fundamentals and whale activity now form a compelling bullish case.

XRP Set to Capture $21 Trillion from SWIFT? Ripple’s Bold Prediction

Ripple CEO Brad Garlinghouse forecasts a seismic shift in global payments, predicting XRP Ledger could capture 14% of SWIFT's $150 trillion annual volume—equivalent to $21 trillion—within five years. Traditional banking rails are losing ground as financial institutions prioritize speed and cost efficiency.

On-chain metrics reveal surging XRPL adoption: daily transactions exceed 830,000, active addresses top 29,000, and DEX volumes hit $12 million. The network's June 30 EVM-compatible sidechain launch catalyzed development, with 1,400+ smart contracts deployed in its first week alone.

This infrastructure expansion transforms XRPL from a cross-border payment specialist into a multi-faceted DeFi ecosystem. Stablecoin transfers maintain $5.6 million daily liquidity while meme coin trading contributes $6.25 million—signaling broadening retail and institutional engagement.

Ripple News: 231M XRP Whale Movements Signal Strategic Accumulation

XRP markets are buzzing after two whales moved 231 million tokens worth $809 million in 24 hours. The larger transfer involved 210.6M XRP ($738M) from a dormant wallet to a new address, while Upbit saw a separate 20M XRP ($71M) purchase. These movements suggest institutional positioning rather than profit-taking, coming days after XRP hit all-time highs.

South Korean trading activity continues to fuel momentum, with analysts projecting ambitious targets of $5.85 by September and $9.76 by year-end. The accumulation follows reports of whales buying 2.2B XRP during the recent rally, indicating sustained confidence among large holders.

XRP Price Surge Continues as Open Interest Hits All-Time High

XRP price extended its rally on Monday, July 21, building on a bullish trend that began June 22 when it bottomed at $1.9121. The token surged to $3.55, marking a 120% increase from its April low, with technical indicators suggesting further upside potential.

The rally gained momentum after former President Donald Trump signed the GENIUS Act into law, a regulatory framework favorable to Ripple Labs' RLUSD stablecoin. Launched in December, RLUSD has seen its market cap swell to $520 million, steadily closing the gap with PayPal's PYUSD. Analysts highlight its transparency and custody at Bank of New York Mellon as key strengths.

Institutional demand is accelerating, with the Teucrium 2x XRP ETF nearing $500 million in assets under management just three months post-launch. Retail participation is similarly robust, reinforcing XRP's position as a standout performer in the digital asset space.

XRP Surges to Multi-Year High as Ripple Ledger Activity Accelerates

XRP has shattered its 2018 record, soaring to $3.70 amid a 50% spike in daily transaction volume on the XRP Ledger. The $1.4 billion activity surge signals a full ecosystem breakout, with institutional and retail interest converging. "We're witnessing an unprecedented spike in XRPL activity, marking renewed confidence from both the developer ecosystem and institutional players," says Ripple CTO David Schwartz.

Technical indicators flash bullish: the 20-day SMA crossed above the 200-day SMA while MACD and signal lines hold above zero. Derivatives open interest climbs alongside spot volume, suggesting sustained momentum. Regulatory tailwinds may amplify the move—the White House's forthcoming crypto policy report could solidify XRP's compliance advantage.

Market structure appears to be forming a bullish pattern, with traders now speculating about a potential $10 price target. The convergence of technical strength, institutional adoption, and regulatory clarity creates a rare trifecta for the embattled asset.

XRP Tests Key Resistance at $3.50 Amid Bullish Momentum

XRP surged to a peak of $3.66 before settling at $3.50, marking a 23.33% weekly gain. Trading volume hit $8.2 billion in 24 hours as buyers tested resistance between $3.50-$4.00—a zone analysts warn could trigger profit-taking.

Technical indicators show stability with RSI at 55.18 and flat MACD, but the $3.00 support level remains critical. A pullback to this threshold may offer strategic entry points, according to market observers.

Open interest climbed 6.86% to $11.01 billion, signaling sustained trader conviction. The coin's 40% rally since breaking $2.50 now faces its toughest test yet at the psychological $4.00 barrier.

The GENIUS Act and Its Implications for Ripple and XRP Investors

The GENIUS Act, recently signed into law by President Donald Trump, establishes a regulatory framework for stablecoin issuers like Ripple. While this development provides clarity for Ripple's upcoming stablecoin, RLUSD, its direct impact on XRP's price remains limited.

Ripple's RLUSD positions the company to compete with dominant stablecoins such as USDC and PayPal USD in the U.S. market. "Ripple is uniquely positioned to benefit from this new legislation," noted Austin King of Omni Network, highlighting the advantage for institutional adoption.

Legal ambiguity around XRP's classification persists, with future clarity dependent on the passage of the proposed CLARITY Act. Ripple's cross-border expertise may give RLUSD an edge, but the broader implications for XRP investors remain uncertain.

Ripple Price Prediction As Trump Tweets About Crypto

XRP has surged to a recent high of $3.65, with analysts eyeing the $4 threshold as the next target. The token now oscillates between $2.35 and $3.50, with $3.50 acting as a critical resistance level. A decisive close above this mark could propel XRP toward $4, while a drop below $3.35 may trigger a short-term correction to $3.10—viewed by many as a buying opportunity.

Market sentiment received an unexpected boost from former U.S. President Donald Trump, who amplified crypto discourse by sharing a Bitcoin explainer video. Though not directly mentioning XRP, the move underscored growing political attention toward digital assets. Meanwhile, speculation about a potential XRP ETF in 2025 gains traction, signaling institutional pathways for the token.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, BTCC's John provides these projections:

| Year | Conservative Target | Bullish Scenario | Catalysts |

|---|---|---|---|

| 2025 | 4.80 USDT | 6.20 USDT | ETF approvals, GENIUS Act |

| 2030 | 18.50 USDT | 35.00 USDT | SWIFT integration, CBDC adoption |

| 2035 | 42.00 USDT | 75.00 USDT | Full institutional adoption |

| 2040 | 90.00 USDT | 150.00 USDT | Global reserve asset status |

These estimates assume continued Ripple ecosystem growth and favorable regulations. Volatility remains high in crypto markets.